endcrypto.site Overview

Overview

What Does A Bankruptcy Lawyer Do

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code. This website contains general information about various areas. Most lawyers will let you pay your attorneys' fees in installments if you need time to come up with the entire retainer. But as discussed, the lawyer won't file. Bankruptcy attorneys are lawyers who assist bankruptcy filers throughout the bankruptcy process. Learn more about what they do and hiring one. We are here to get you through the bankruptcy process as efficiently and affordably as possible — with personal attention, flexible payment plans and other. Documents are signed by debtors and filed with the court under penalty of perjury. A debtor's property rights are affected by filing bankruptcy. It is not. A bankruptcy attorney will help you determine if you qualify for this form of legal assistance. If you are eligible, the attorney will put the necessary. 7 Things Your Bankruptcy Lawyer Should Do For You · 1. Know the Latest on Bankruptcy Law · 2. Handle the Paperwork · 3. Outline Your Options · 4. Sort Out. What Does a Bankruptcy Lawyer Do? As a bankruptcy lawyer, you represent creditors and debtors in bankruptcy courts. Your clients may be individuals. How a Lawyer Can Help With Your Chapter 7 or Chapter 13 Bankruptcy · Offer protection from creditors — While an automatic stay goes into effect when you file. We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code. This website contains general information about various areas. Most lawyers will let you pay your attorneys' fees in installments if you need time to come up with the entire retainer. But as discussed, the lawyer won't file. Bankruptcy attorneys are lawyers who assist bankruptcy filers throughout the bankruptcy process. Learn more about what they do and hiring one. We are here to get you through the bankruptcy process as efficiently and affordably as possible — with personal attention, flexible payment plans and other. Documents are signed by debtors and filed with the court under penalty of perjury. A debtor's property rights are affected by filing bankruptcy. It is not. A bankruptcy attorney will help you determine if you qualify for this form of legal assistance. If you are eligible, the attorney will put the necessary. 7 Things Your Bankruptcy Lawyer Should Do For You · 1. Know the Latest on Bankruptcy Law · 2. Handle the Paperwork · 3. Outline Your Options · 4. Sort Out. What Does a Bankruptcy Lawyer Do? As a bankruptcy lawyer, you represent creditors and debtors in bankruptcy courts. Your clients may be individuals. How a Lawyer Can Help With Your Chapter 7 or Chapter 13 Bankruptcy · Offer protection from creditors — While an automatic stay goes into effect when you file.

So what does a bankruptcy lawyer do? They are an unbiased party there to aid you in taking a critical look at your debts and assets to determine if bankruptcy. Individuals can file bankruptcy without an attorney, which is called filing pro se. However, seeking the advice of a qualified attorney is strongly recommended. Filing personal bankruptcy without an attorney is a bit like performing your own surgery. You could always try, but it is not a good idea. Bankruptcy law allows. What does a bankruptcy lawyer do? A bankruptcy lawyer specializes in providing legal counsel and representation to individuals or businesses facing financial. What Does a Bankruptcy Attorney Do? Bankruptcy attorneys specialize in helping their clients use the court system to reduce or eliminate debts, file for. One of the biggest concerns for individuals considering bankruptcy is the impact on their assets and credit score. Experienced attorneys can help in developing. Bankruptcy attorneys have intimate knowledge of the legal process of filing for bankruptcy and will ensure all the appropriate paperwork is in order and every. Instead, they work with them to find a solution to their financial problems, whether that is bankruptcy or another solution such as credit counseling or debt. The Trustee in Bankruptcy represents the creditors, and they always get paid first. · Bankruptcy lawyers (and lawyers in general) take retainers. The trustee will pay the attorney in installments, out of your monthly plan payments. This usually works by applying payments made early in the case to. What Does a Bankruptcy Attorney Do? There are two different types of bankruptcy attorneys: commercial bankruptcy attorneys who will help you file for. Our goal is to solve immediate problems and help you make long-term, smart financial decisions. Whether we begin our legal representation with debt relief. “Although general practice has gone the way of the dinosaur, bankruptcy is the last place at a top law firm where you can be what lawyers used to be: the. Hire a Bankruptcy Lawyer If You Have a Complicated Case Chapter 7 does a great job of stopping creditors and wiping out qualifying debts like credit card. What Will a Bankruptcy Lawyer Help Do? · Complete the schedules and other paperwork. · Guide you through the bankruptcy case. · Provide accurate and complete. This information could include why you are deciding to file for bankruptcy, what kind of income you have, and what types of debt you have. Having the list of. An attorney's responsibilities include preparing paperwork, assisting the client through hearings, and ensuring that all eligible debts are discharged at the. Bankruptcy lawyers are meant to help deal with harassing creditors, meet with the court systems to set up payment plans or repayment programs, gather together. One of the biggest concerns for individuals considering bankruptcy is the impact on their assets and credit score. Experienced attorneys can help in developing. Individuals can file bankruptcy without an attorney, which is called filing pro se. However, seeking the advice of a qualified attorney is strongly recommended.

What Is The Best Vitamix For Smoothies

All Creations models, except the Elite, are C-Series Vitamix blenders based on the including the Creations II and Creations CG. These models are best. For the best homemade smoothies, soups, dips and more, bring the unrivaled power of Vitamix blenders to your kitchen. Founded in , Vitamix has long promoted. We've currently tested 16 Vitamix blenders. This manufacturer specializes in full-size blenders that fall on the higher end of the price range for blenders. Of course, we can only answer this question subjectively: Currently, the Vitamix Pro with liter container is not only the best Vitamix for us, but also. Vitamix Blenders. Vitamix is a well established and well trusted name—they make the best blenders! The price is a little higher than a cheap throwaway $59 food. Explore our collection of Vitamix blenders, the all-in-one kitchen complement. Our Classic and Smart System Blenders are designed to make blending easy and. The Propel Series combines iconic Vitamix performance with the convenience of automatic blending programs. It's the perfect blend of power and convenience. The Best Blenders · Editor&aposs Note:Update, August · Vitamix · Breville Fresh & Furious · NutriBullet Full Size Blender · Sign up for the Well-Equipped. Yes if you will be using it. Vitamix can do more tasks than other blenders and do it better so less frustration. Also they last longer so the. All Creations models, except the Elite, are C-Series Vitamix blenders based on the including the Creations II and Creations CG. These models are best. For the best homemade smoothies, soups, dips and more, bring the unrivaled power of Vitamix blenders to your kitchen. Founded in , Vitamix has long promoted. We've currently tested 16 Vitamix blenders. This manufacturer specializes in full-size blenders that fall on the higher end of the price range for blenders. Of course, we can only answer this question subjectively: Currently, the Vitamix Pro with liter container is not only the best Vitamix for us, but also. Vitamix Blenders. Vitamix is a well established and well trusted name—they make the best blenders! The price is a little higher than a cheap throwaway $59 food. Explore our collection of Vitamix blenders, the all-in-one kitchen complement. Our Classic and Smart System Blenders are designed to make blending easy and. The Propel Series combines iconic Vitamix performance with the convenience of automatic blending programs. It's the perfect blend of power and convenience. The Best Blenders · Editor&aposs Note:Update, August · Vitamix · Breville Fresh & Furious · NutriBullet Full Size Blender · Sign up for the Well-Equipped. Yes if you will be using it. Vitamix can do more tasks than other blenders and do it better so less frustration. Also they last longer so the.

Vitamix E Blender review · + Great container size · + A cheaper, utilitarian model · + The smoothest smoothies · + Frozen fruit is fine · + Other negatives. Blendtec takes the lead with a peak HP motor in their Designer when it comes to raw power compared to Vitamix's HP motor. It's worth noting that. With a Vitamix blender, you can transform ingredients into smoothies, hot soups, and frozen desserts, all with the twist of a knob. The precision and power. The Best Vitamix Blenders Make Impeccable Purees · Best Overall: Vitamix · Best Value: Vitamix Explorian E · Best for Small Kitchens: Vitamix ONE · Best. It's true, the best smoothie you've ever had was probably made in a Vitamix blender, but smoothies are just the beginning. You can also make hot soup (no. Hello, is there a tip on how to chose the best Vitamix Blender? I want the overall best with large container for smoothies. The Vitamix E Explorian blender is a good choice if you want a mid-level model in terms of size, power, and price. You'll get a nice smooth blend with this. Blendtec takes the lead with a peak HP motor in their Designer when it comes to raw power compared to Vitamix's HP motor. It's worth noting that. Chop, blend, cream, or puree every food you can fathom, great for smoothies, soups and frozen desserts. Oprah chose the Vitamix blender as one of her favorite. Vitamix E Blender review · + Great container size · + A cheaper, utilitarian model · + The smoothest smoothies · + Frozen fruit is fine · + Other negatives. I chose a Blend-tek Home blender over a Vita Mix because I believe it is easier to use and more versatile, also less expensive and more powerful. A high speed. Best Buy customers often prefer the following products when searching for best vitamix blender. · Vitamix - Ascent A Blender - White · Vitamix - Ascent. Best Blenders Review (Vitamix, KitchenAid, Blendtec) · Cons: · Cost: $ Weight: 21 pounds · Noise: /5 – overall louder than the other two blenders due to. Founded in Olmsted Falls, Ohio in , Vitamix produces top-quality blenders that bring commercial-grade power and versatility to the home. It is beautiful and powerful. It makes my smoothies so smooth. Vitamixes in general are the best of the best when it comes to blenders. Many family members have. It's true, the best smoothie you've ever had was probably made in a Vitamix blender, but smoothies are just the beginning. You can also make hot soup (no. The best blenders of , tested by editors · prime day vitamix · breville super q endcrypto.site · Ninja BN Professional Plus DUO endcrypto.site Add a touch of lemon or lime juice. Work your machine back up to its highest speed, and process for seconds. Tip: Fruits add their own natural sweetness. Chop, blend, cream, or puree every food you can fathom, great for smoothies, soups and frozen desserts. Oprah chose the Vitamix blender as one of her favorite. Both have good warranties, BPA free carafes, and are a great choice as a home blender. The reason that the new Vitamix still wins in my book is that the lid has.

How To Get Free Checks

Answers to questions about ordering checks, stop payments or cancelling checks, viewing checks online, safe deposit boxes, and more. Walmart checks start at $ for a pack of Free standard shipping takes about 12 business days from the time your order is received. Two-day delivery. Overall, Walmart Checks is the best place to order checks online for their combination of low prices, great selection and fast (and free) shipping. If you're a. Order checks online from the official Harland Clarke store. Reorder personal checks, business checks, checkbook covers, check registers, and other check. Order personal checks from KeyBank. Key offers several ways to order and reorder checks including online, by phone or at a nearby branch. As part of our promise of fee-free banking, every Amplify member will receive one free box of standard checks per year. This applies to each checking account. Order checks for your Chase business or personal accounts. Access online or visit the nearest Chase branch to order checks. Are you eligible for a box of free checks through My Member Perks ®? You can order those at a branch or by calling the Contact Center. Then, they'll be shipped. per pack. On Personal Checks. Free Shipping & Processing*. Use code new Shop Now →. 20% OFF all personal checks - Shop Now. Get your coffee fix and save! Answers to questions about ordering checks, stop payments or cancelling checks, viewing checks online, safe deposit boxes, and more. Walmart checks start at $ for a pack of Free standard shipping takes about 12 business days from the time your order is received. Two-day delivery. Overall, Walmart Checks is the best place to order checks online for their combination of low prices, great selection and fast (and free) shipping. If you're a. Order checks online from the official Harland Clarke store. Reorder personal checks, business checks, checkbook covers, check registers, and other check. Order personal checks from KeyBank. Key offers several ways to order and reorder checks including online, by phone or at a nearby branch. As part of our promise of fee-free banking, every Amplify member will receive one free box of standard checks per year. This applies to each checking account. Order checks for your Chase business or personal accounts. Access online or visit the nearest Chase branch to order checks. Are you eligible for a box of free checks through My Member Perks ®? You can order those at a branch or by calling the Contact Center. Then, they'll be shipped. per pack. On Personal Checks. Free Shipping & Processing*. Use code new Shop Now →. 20% OFF all personal checks - Shop Now. Get your coffee fix and save!

Some Gate City Bank accounts are eligible to receive free checks. Otherwise, pricing depends on a few factors, such as quantity, design and account balance. We have three easy ways to order checks: online, by phone, or at a branch. Checks are a valuable and secure way to make transactions. Even in our digital world. Order Checks - Cheap, Fast & Easy! · Personal Checks - 2,+ Original Designs + Free Shipping! · Business Checks - Bank Approved. Guaranteed. · Thank You for. Simply sign in to digital banking*, click Account and under 'Manage Account' select Order checks. Feel free to repeat a previous order, or choose new designs. To order your free checks, follow the simple steps below. Step 1: Sign in to online banking. Step 2: Choose either Checking or Money Market Savings Account. You can order, reorder and track the status of your personal checks by choosing Services under the Customer Service menu in Regions Online Banking, or Mobile. Check orders with Bank of America are secure, quick and can be done from virtually anywhere. Choose and order personalized checks for your account right. Find out why Checks Unlimited is #1 for Checks Direct! Order checks online and enjoy up to 50% off 4 boxes of personal checks with code DEAL. Simply Free Checking · eChecking Also available: address labels, checkbook covers, deposit tickets, check registers and more. Order Checks Online. Do you offer free checks? No. Members can pay bills for free using our online bill pay services. Bill Payment is available in Online Banking for members and. Some Gate City Bank accounts are eligible to receive free checks. Otherwise, pricing depends on a few factors, such as quantity, design and account balance. Order personal checks for your Citizens checking account. Learn how to order your preferred style of checks online, in person at one of our branches. 1. Best Overall: Walmart Checks Without question, Walmart is the best place to order checks. Walmart Checks offers a huge selection of personal and business. Answers to questions about ordering checks, stop payments or cancelling checks, viewing checks online, safe deposit boxes, and more. Order checks for your Chase business or personal accounts. Access online or visit the nearest Chase branch to order checks. You'll need to start a check order to see which checks are free or have a discount. To begin a check order using online banking. Choose the checking account. A menu of check options will appear. If you receive free or discounted checks with your checking account, choose "Exclusives" from the menu on the left. Select. Find out why Checks Unlimited is #1 for Checks Direct! Order checks online and enjoy up to 50% off 4 boxes of personal checks with code DEAL. Order personal checks for your Citizens checking account. Learn how to order your preferred style of checks online, in person at one of our branches. per pack. On Personal Checks. Free Shipping & Processing*. Use code new Shop Now →. 20% OFF all personal checks - Shop Now. Get your coffee fix and save!

Top Rated Homeowners Insurance Companies

The best homeowners insurance companies as of October are State Farm and USAA, as they provide great coverage at low costs. Amica Mutual is one of the best insurance companies in New York and it has actually earned the highest score from JD Power and Associates for thirteen years in. State Farm: Best home insurance in New York. Nationwide: Best home insurance for high-value houses. Travelers: Great home insurance for customer. CHUBB Group · Chubb Insurance Company of NJ · Federal Insurance Company · Great Northern Insurance Company · Pacific Indemnity Company · Vigilant Insurance Company. Homeowner Insurance. from Ieuter Insurance Group. Michigan Homeowners Insurance. Whether you own or rent, insuring the place you call home. The largest P&C insurers in the United States ; 2, Berkshire Hathaway Ins, 77,, ; 3, Progressive Ins Group, 61,, ; 4, Allstate Ins Group, 47,, ; 5. Average homeowners insurance costs in New York from the Best Rated Home Insurance Companies in New York State. Metlife, Travelers, Progressive, Farmers. While customer satisfaction can vary based on individual experiences, overall, Edison Insurance has a strong reputation for providing quality service and. State Farm and Allstate are the best companies for bundling home and auto insurance. State Farm's low rates for both home and car insurance mean that its. The best homeowners insurance companies as of October are State Farm and USAA, as they provide great coverage at low costs. Amica Mutual is one of the best insurance companies in New York and it has actually earned the highest score from JD Power and Associates for thirteen years in. State Farm: Best home insurance in New York. Nationwide: Best home insurance for high-value houses. Travelers: Great home insurance for customer. CHUBB Group · Chubb Insurance Company of NJ · Federal Insurance Company · Great Northern Insurance Company · Pacific Indemnity Company · Vigilant Insurance Company. Homeowner Insurance. from Ieuter Insurance Group. Michigan Homeowners Insurance. Whether you own or rent, insuring the place you call home. The largest P&C insurers in the United States ; 2, Berkshire Hathaway Ins, 77,, ; 3, Progressive Ins Group, 61,, ; 4, Allstate Ins Group, 47,, ; 5. Average homeowners insurance costs in New York from the Best Rated Home Insurance Companies in New York State. Metlife, Travelers, Progressive, Farmers. While customer satisfaction can vary based on individual experiences, overall, Edison Insurance has a strong reputation for providing quality service and. State Farm and Allstate are the best companies for bundling home and auto insurance. State Farm's low rates for both home and car insurance mean that its.

A canine liability exclusion, a component of homeowner's insurance policies, indemnifies the insurance company against damages caused by the policyholder's dogs. Top 10 Tips for Finding Residential Insurance insurance company covering your residential property, visit our Residential Insurance Policy Locator page. As a Top 50 Property & Casualty Insurance company, our Hawaii homeowners insurance policies have protected local people since rated “A” (Excellent). Get the best-loved homeowners insurance in America. % digital. No “An Insurance Company That Homeowners Actually Might Love (Seriously)”. Consumer Reports\' homeowners insurance guide answers key questions. CR explains how to buy, own, and use homeowners insurance effectively and economically. SelectQuote shops and compares home insurance quotes from top-rated companies to help save you time and money. Call to start your free quote! Michigan's Best Homeowners Insurance Companies: Our Top Picks · Amica: Best for customer satisfaction · USAA: Military-focused coverage · State Farm: Largest. The best homeowners insurance company in Kansas is Amica, according to our study. The company scored out of 5. Amica offers a wide range of home insurance. The Hartford, selling home insurance to AARP members, is consistently one of the highest rated home insurance companies in the industry. It's a good idea to shop around to find the policy that best meets your needs and pocketbook. Do you need renters insurance? (video) Do you need renters. The best homeowners insurance companies are Amica Mutual, Travelers, Allstate, State Farm, Safeco, Liberty Mutual, Progressive, and USAA. Amica. The highest rated the best for customer service, Amica Insurance offers several benefits to their consumers. Not just covering home owners insurance. What are the best homeowners insurance companies for claims service? ; Geico, , ; Nationwide, , ; American Family, , ; Liberty Mutual, Top 10 Tips for Finding Residential Insurance insurance company covering your residential property, visit our Residential Insurance Policy Locator page. 1. State Farm · 2. Allstate Corp. · 3. USAA Insurance Group · 4. Farmers Insurance Group · 5. Liberty Mutual · 6. Travelers Companies Inc. · 7. Nationwide Mutual. Insurance Companies Toggle submenu. Address Maintenance Tool · Certified homeowner insurance premiums being offered in Colorado. Homeowners Insurance. For example, some insurers will not write a policy to a homeowner who owns a certain breed of dog. Please contact your agent or company if you have specific. What sets USAA apart? USAA Homeowners Insurance ranks among the top home insurers for its customer experience. As a USAA member, you'll get quality coverage. AM Best is a global credit rating agency, news publisher and data analytics provider specializing in the insurance industry. Headquartered in the United States. There is no “best homeowners insurance provider” Each provider will give each person a completely different quote. It depends on your general.

Kyc Collect

KYC means “Know Your Customer.” It describes the process of verifying the identity of (new) customers. Our market leading solution is built on Counterparty Manager, ensuring entity data, document collection, tax profile validation, regulatory protocols and self-. Know Your Client (KYC) are a set of standards used in the investment services industry to verify customers and their risk and financial profiles. KYC is a set of guidelines financial institutions must follow to collect and verify the identity of their customers in order to protect against financial crime. It also includes a payment solution, i.e., Mews Payments. As you probably know, banks and other financial service providers are required by law to collect. What are KYC documents? There may be specific KYC documents that a business needs to collect for KYC and customer due diligence, for example a copy of their. KYC means Know Your Customer and sometimes Know Your Client. KYC or KYC check is the mandatory process of identifying and verifying the client's identity. Avallone's KYC Collection software, tailored to optimize data collection and verification via screening, will further your compliance and business operations. Know Your Customer” (KYC) references a set of guidelines that financial institutions follow to verify the identity and risks of a customer. KYC means “Know Your Customer.” It describes the process of verifying the identity of (new) customers. Our market leading solution is built on Counterparty Manager, ensuring entity data, document collection, tax profile validation, regulatory protocols and self-. Know Your Client (KYC) are a set of standards used in the investment services industry to verify customers and their risk and financial profiles. KYC is a set of guidelines financial institutions must follow to collect and verify the identity of their customers in order to protect against financial crime. It also includes a payment solution, i.e., Mews Payments. As you probably know, banks and other financial service providers are required by law to collect. What are KYC documents? There may be specific KYC documents that a business needs to collect for KYC and customer due diligence, for example a copy of their. KYC means Know Your Customer and sometimes Know Your Client. KYC or KYC check is the mandatory process of identifying and verifying the client's identity. Avallone's KYC Collection software, tailored to optimize data collection and verification via screening, will further your compliance and business operations. Know Your Customer” (KYC) references a set of guidelines that financial institutions follow to verify the identity and risks of a customer.

In some cases, additional information may also be collected, such as a customer's employment history or financial history. The goal of the KYC process is to. Collecting documents needs to be seamless — that's where Onfido comes in. With digital identification, banks can verify the identities of customers by. What does KYC look like in practice? When underwriting and onboarding merchants, payment facilitators must collect information from them through merchant. A key ethical issue in data collection for KYC, CDD, and AML compliance is the principle of data minimisation. Financial institutions must ensure that they. KYC, or "Know Your Customer", is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and. Collect banking customer details and e-signatures with a free online KYC Form. Easy to customize, embed, and share. Store data securely. No coding required. KYC processes are also employed by companies of all sizes for the purpose of In enforcing this rule these organizations are expected to collect all. To verify a customer, it is minimally required to collect the following information: Name; Date of birth; Address; Identification number. Documents such as a. Step 1: Identity Verification. The first step in KYC verification is to collect identifying information about the customer(s) in question. There are two. Know Your Client (“KYC”). Within your CrowdStreet Profile, we collect the necessary information to complete AML and KYC checks. This includes (but is not. From time to time we'll reach out to you to confirm your personal and/or business details as part of our 'Know Your Customer' (KYC) requirements under. You'll see us refer to this as our 'Know Your Customer' (KYC) requirements collect, verify and maintain customer identification information. In the. VASPs undertake a multi-step KYC process to prevent fraudulent activity. The steps are as follows: Step 1: Collect their customers' personally identifiable. How Does the KYC Process Work? · Collecting personal information from customers (KYC documents) · Checking that information against a database of known fraudulent. AI and ML have shown enormous potential in automating and enhancing KYC procedures. These technologies can automate data collection and verification processes. KYC verification: How Napier uses KYC documents. Napier uses its This storage type usually doesn't collect information that identifies a visitor. Customer Due Diligence (CDD) is a particular aspect of KYC. It involves collecting customer information such as names, places of residence, addresses, and so on. “Know Your Customer” (KYC) obligations for payments require Stripe to collect and maintain information on all Stripe account holders. How Does KYC Verification Work? KYC Verification - How to get started. To complete KYC verification, you must collect your prospective customer's details. Collecting documents needs to be seamless — that's where Onfido comes in. With digital identification, banks can verify the identities of customers by.

Best Long Call Options To Buy Now

In our example, the maximum risk of buying one call options contract (which grants you the right to control shares) is $ The risk of buying the call. You buy a call option with a strike price of $ and an expiration date six months from now. The call option costs you a premium of $15 per share. Since. Bullish traders may own calls instead of buying stock. Another common strategy is selling them against long-equity positions, which is known as a covered call. In buying call options, the investor's total risk is limited to the premium paid for the option. Their potential profit is, theoretically, unlimited. It is. buy shares of a great company if they dip in price. Then you can hold them for as long or short of a time as you want to. By selling put options, you can. A long call gives you the right to buy the underlying stock at strike price A. Calls may be used as an alternative to buying stock outright. You can profit if. Long call options give the buyer the right, but no obligation, to purchase shares of the underlying asset at the strike price on or before expiration. The two most consistently discussed strategies are: (1) Selling covered calls for extra income, and (2) Selling puts for extra income. The Stock Options Channel. Options with a delta of or higher are generally considered to be “in the money” and may be a good choice for buyers. You should also look at the bid-ask. In our example, the maximum risk of buying one call options contract (which grants you the right to control shares) is $ The risk of buying the call. You buy a call option with a strike price of $ and an expiration date six months from now. The call option costs you a premium of $15 per share. Since. Bullish traders may own calls instead of buying stock. Another common strategy is selling them against long-equity positions, which is known as a covered call. In buying call options, the investor's total risk is limited to the premium paid for the option. Their potential profit is, theoretically, unlimited. It is. buy shares of a great company if they dip in price. Then you can hold them for as long or short of a time as you want to. By selling put options, you can. A long call gives you the right to buy the underlying stock at strike price A. Calls may be used as an alternative to buying stock outright. You can profit if. Long call options give the buyer the right, but no obligation, to purchase shares of the underlying asset at the strike price on or before expiration. The two most consistently discussed strategies are: (1) Selling covered calls for extra income, and (2) Selling puts for extra income. The Stock Options Channel. Options with a delta of or higher are generally considered to be “in the money” and may be a good choice for buyers. You should also look at the bid-ask.

When you buy a call option, you're buying the right to purchase a specific Just remember that some options may not have a large pool of potential buyers. Options trading can provide an effective way for investors to make money. Get expert tips on the best option trades right now. Buying a call is much cheaper than buying shares of the underlying stock, giving you lots of leverage for relatively little capital. · Like owning shares, a. Call Options and Put Options · Call options. Calls give the purchaser of the option the right (but not the obligation) to buy stock from the writer of the option. Today's most active Stock options – call options and put options with the highest daily volume. options for a profit. This is the basic principle for how calls work today; now we have other factors such as financial intruments and commodities instead. Good-for-day (GFD) orders on options. A GTC With a Level 2 designation, you can execute options trades like: Long calls, Covered calls, and Long puts. To plan ahead and lock in the price of the stock today, you could purchase a long call with the intent to exercise your right to purchase the shares once you. Purchasing a call is one of the most basic options trading strategies and is suitable when sentiment is strongly bullish. It can be used as a leveraging. LONG CALL (BULLISH) The call buyer wants the stock price to increase well above the call strike price by the expiration of the contract so they can purchase. Buying Calls (Long Calls) There are some advantages to trading options for those looking to make a directional bet in the market. If you think the price of an. Buying (going long) a call is among the most basic option strategies. It is a relatively low-risk strategy since the maximum loss is restricted to the premium. When you buy to open call options, you are making a bet that the underlying stock will rise in value. If you buy one call contract, you are essentially long. Some of the best options to trade are the large stocks like Amazon, Google, and Alibaba. Stocks like these tend to move quite a bit throughout the day. One. What draws investors to the covered call options strategy? A covered call gives someone else the right to purchase stock shares you already own (hence "covered"). A standard equity long call option gives you the right, but not the obligation, to buy shares of the underlying asset on or before an expiration day in. A long call grants the option to purchase an asset at a predetermined price in the future, an alternative to immediate stock purchase. It allows potential. When most people first learn about options, it's in the context of buying call If you're long a stock, but short a call option against it, you're exposed. A long call option gives you the right, but not the obligation, to buy the underlying stock at the strike price by the expiration date. Options ; CrowdStrike Stock Today: As Earnings Approach, This Double Butterfly Trade Could Fly Into Profit Territory. August 23, ; Use Option Strategy To.

Gps Stock Forecast

What is the Gap stock forecast? · Gap stock prediction for 1 year from now: $ (%) · Gap stock forecast for $ (%) · Gap stock. The stock price for (NYSE: GPS) is $ last updated August 21, at PM EDT. View Gap, Inc. GPS stock quote prices, financial information, real-time forecasts, and company news from CNN. GPS Earnings-Related Price Changes ; May 30, , $, $, +% ; Mar 07, , $, $, +%. On October 9th, , our AI-powered stock forecast predicted that GPS was a strong buy trading at only $ for the 3-month time horizon. GPS stock results show that Gap beat analyst estimates for earnings per share and beat on revenue for the first quarter of 3 Activewear Stocks I'd Rather. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. The 1 analyst with a month price forecast for The Gap stock has a target of 26, which predicts an increase of % from the current stock price of Future price of the stock is predicted at $ (%) after a year according to our prediction system. This means that if you invested. What is the Gap stock forecast? · Gap stock prediction for 1 year from now: $ (%) · Gap stock forecast for $ (%) · Gap stock. The stock price for (NYSE: GPS) is $ last updated August 21, at PM EDT. View Gap, Inc. GPS stock quote prices, financial information, real-time forecasts, and company news from CNN. GPS Earnings-Related Price Changes ; May 30, , $, $, +% ; Mar 07, , $, $, +%. On October 9th, , our AI-powered stock forecast predicted that GPS was a strong buy trading at only $ for the 3-month time horizon. GPS stock results show that Gap beat analyst estimates for earnings per share and beat on revenue for the first quarter of 3 Activewear Stocks I'd Rather. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. The 1 analyst with a month price forecast for The Gap stock has a target of 26, which predicts an increase of % from the current stock price of Future price of the stock is predicted at $ (%) after a year according to our prediction system. This means that if you invested.

- GPS Stock was down % · Gap Inc. · The downward trend in Gap's stock could be linked to the underwhelming Q2 earnings report by Wayfair (W). Is the Analyst Rating (GPS) correct? A. While ratings are subjective and will change, the latest (GPS) rating was a upgraded with a price target of $ to. With an AI score of 45, the GPS stock forecast suggests stability. What is the GPS price prediction for ? To predict the price for GPS in , we. Wall Street analysts forecast GPS stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for GPS is. Gap Stock Forecast · Over the next 52 weeks, Gap has on average historically risen by % based on the past 48 years of stock performance. · Gap has risen. Stock Screener · Mutual Fund Screener · ETF Screener · Premium Screens · Basic Screens · Thematic Screens · Research Wizard. Finance. Finance. Personal Finance. Valuation. Buy Or Fear Gap (GPS) Stock? · Financials. What Drove the % Net Income Change for Gap in FY? · Return. Gap During Recession vs. According to the research reports of 16 Wall Street equities research analysts, the average twelve-month stock price forecast for GAP is $, with a high. Is Gap Stock Undervalued? The current Gap [GPS] share price is $ The Score for GPS is 61, which is 22% above its historic median score of 50, and infers. View the latest Gap Inc. (GPS) stock price, news, historical charts, analyst ratings and financial information from WSJ. According to one analyst, the rating for GAP stock is "Hold" and the month stock price forecast is $ Retail stock Gap (GPS) looked ready for a. Find the latest Gap, Inc. (The) GPS analyst stock forecast, price target, and recommendation trends with in-depth analysis from research reports. Gap Stock Forecast, GPS stock price prediction. Price target in 14 days: USD. The best long-term & short-term Gap share price prognosis for The average one-year price target for The Gap, Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price target is the. Gap Stock Soars 17% as Earnings Crush Expectations and Revenue Also Beats Them In fiscal Q3, the casual-apparel retailer's profit sped by Wall Street's. The consensus among 15 Wall Street analysts covering (NYSE: GPS) stock is to Buy GPS stock. Out of 15 analysts, 6 (40%) are recommending GPS as a Strong Buy. Looking back, over the last four weeks, Gap lost percent. Over the last 12 months, its price rose by percent. Looking ahead, we forecast Gap to be. The average stock forecast for Gap Inc (GPS) is USD. This price target corresponds to an upside of %. The range of stock forecasts for Gap is. On average, Wall Street analysts predict that Gap's share price could reach $ by Aug 30, The average Gap stock price prediction forecasts a potential. Gap Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions.

Dscr Formula

On Working Capital ; Interest, , ; Total -B · , ; DSCR = A/B · , Put another way, the Debt Service Coverage Ratio is a measure of a property's ability to absorb changes in income and/or expenses while maintaining its ability. To find your DSCR, you'll need to divide your net operating income by your debt service, including principal and interest. Let's break those terms down a bit. What is Debt Service Coverage Ratio (DSCR) and as a Chicago real estate investor why should you care? DSCR is a measurement of your property's net cash flow. A DSCR loan, short for Debt Service Coverage Ratio loan, offers real estate investors an opportunity to secure financing for an investment property based on. The DSCR is calculated as a ratio of your housing expenses (including principal, interest, taxes, insurance and HOA dues) divided by your gross monthly income. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. Whatever industry you're in, banks and lenders will look at your DSCR to determine whether you can pay back a loan. They usually want this ratio to be more than. What Is DSCR? It's Debt Service Coverage Ratio · DSCR = Annual Net Operating Income/Annual Debt Payments · Net Operating Income Formula · Debt Payments Formula. On Working Capital ; Interest, , ; Total -B · , ; DSCR = A/B · , Put another way, the Debt Service Coverage Ratio is a measure of a property's ability to absorb changes in income and/or expenses while maintaining its ability. To find your DSCR, you'll need to divide your net operating income by your debt service, including principal and interest. Let's break those terms down a bit. What is Debt Service Coverage Ratio (DSCR) and as a Chicago real estate investor why should you care? DSCR is a measurement of your property's net cash flow. A DSCR loan, short for Debt Service Coverage Ratio loan, offers real estate investors an opportunity to secure financing for an investment property based on. The DSCR is calculated as a ratio of your housing expenses (including principal, interest, taxes, insurance and HOA dues) divided by your gross monthly income. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. Whatever industry you're in, banks and lenders will look at your DSCR to determine whether you can pay back a loan. They usually want this ratio to be more than. What Is DSCR? It's Debt Service Coverage Ratio · DSCR = Annual Net Operating Income/Annual Debt Payments · Net Operating Income Formula · Debt Payments Formula.

In commercial lending, debt-service coverage is the ratio between your business's cash flow and debt. Try Peoples State Bank's online calculator today. The DSCR Formula: With NOI and Annual Debt Service in hand, the DSCR is calculated using the formula: DSCR=NOIAnnual Debt ServiceDSCR=Annual Debt ServiceNOI. How to Calculate DSCR. Debt service coverage ratio by definition is the net operating income a property can generate, divided by the amount of Annual Debt. Debt Service Coverage Ratio (DSCR) measures the income from the property versus the operating expenses, ie, how profitable the investment is. The DSCR is calculated by dividing net operating income by total debt service and compares a company's operating income with its upcoming debt obligations. Calculating Debt Service Coverage Ratio (DSCR). To calculate a DSCR, you will need a property's net operating income (NOI) and its mortgage payment. You divide. Debt Service Coverage Ratio (DSCR) is an important financial metric used to assess a business or individual's ability to manage and service debt. The ratio is calculated by taking the expected rental payment and dividing it by the annual mortgage debt RDP (Rent Divided PITIA= DSCR). Contact Angel Oak. To calculate the debt service coverage ratio (DSCR) you divide the annual net operating income by the annual mortgage debt. It's a metric that measures the capacity of a company to repay its debt obligations. In other words, it's a ratio that shows how much cash the company. Debt Service Coverage Ratio (DSCR) Loan:Use Rental Income to Qualify for Investment Properties. A DSCR loan allows real estate investors to secure financing. A Debt Service Coverage Ratio (DSCR) loan looks at the cash flow generated from an investment property to qualify for a mortgage instead of personal income. The debt-service coverage ratio when broken down shows how well (or if) an entity can pay their debts with their current level of income or cash flow. In order. To calculate DSCR, take the monthly rental income and divide it by the monthly expenses. Monthly expenses typically include the principal, interest, taxes. Use this DSCR calculator to find your Debt Service Coverage Ratio before determining what size loan to apply for. If the DSCR Ratio is less than 1, it means the property is cash flow negative. This means the debt obligations exceed the net operating income. Lenders will not. Debt Service Coverage Ratio ("DSCR") = NOI ÷ (Mortgage + Taxes + Insurance). Learn how to calculate DSCR. Debt Service Coverage Ratio (DSCR). Related Content. A financial ratio that measures how easily a borrower can pay interest and make scheduled. Lenders often have a minimum DSCR requirement that borrowers must meet to qualify for a loan. A DSCR of indicates that the borrower's cash flow is just. Lenders use total debt service to measure your ability to repay a mortgage. Learn what a debt service coverage ratio (DSCR) is and how to calculate it.

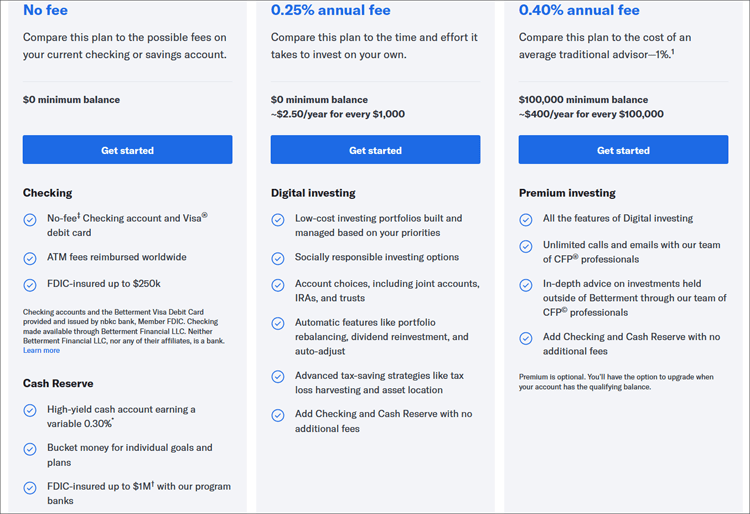

Betterment Monthly Fee

Accounts with less than $20, (across all accounts) will pay $4 per month, though a recurring deposit of $ lets you escape this fee. For new investors with. Where Betterment falls short is with investing fees. Customers pay either $4 per month or an annual fee of % of the account balance, which is steep for. Yes, if your total betterment balance is below $20k or you don't have a recurring deposit over $ set up, you will be charged $4 per month. While there is support for scheduled monthly investments, one-size-fits Betterment earns money from its annual fee: % for its Digital Plan and. The company offers a SaaS application—Betterment for Advisors—that facilitates wealth management, charging a monthly fee of $ plus a tiered. Vanguard does offer a similar service to Betterment and charges % for it (portfolio management + tax loss harvesting + re-balancing). So my endcrypto.site Fees: % (annual) for investing plan accounts with at least $20, or at least $ per month in recurring account deposits. Otherwise, the fee is $4/month. under management and charged monthly or quarterly, as described in Part 2A 6 Betterment at Work charges separate plan administration and. Stocks and Bonds Investing Accounts Betterment's investment advice is available for % (25 bps) per year or $4 per month. Accounts with less than $20, (across all accounts) will pay $4 per month, though a recurring deposit of $ lets you escape this fee. For new investors with. Where Betterment falls short is with investing fees. Customers pay either $4 per month or an annual fee of % of the account balance, which is steep for. Yes, if your total betterment balance is below $20k or you don't have a recurring deposit over $ set up, you will be charged $4 per month. While there is support for scheduled monthly investments, one-size-fits Betterment earns money from its annual fee: % for its Digital Plan and. The company offers a SaaS application—Betterment for Advisors—that facilitates wealth management, charging a monthly fee of $ plus a tiered. Vanguard does offer a similar service to Betterment and charges % for it (portfolio management + tax loss harvesting + re-balancing). So my endcrypto.site Fees: % (annual) for investing plan accounts with at least $20, or at least $ per month in recurring account deposits. Otherwise, the fee is $4/month. under management and charged monthly or quarterly, as described in Part 2A 6 Betterment at Work charges separate plan administration and. Stocks and Bonds Investing Accounts Betterment's investment advice is available for % (25 bps) per year or $4 per month.

So some even have a flat fee structure, like they'll charge you $10 a month or $20 a month or whatever. But if you were like, okay, how does that really shake. Is Betterment worth the cost? Betterment's $4 monthly fee or % annual fee is lower than traditional financial advisors. It could be worth it for. their traditional robo-advisor accounts. Cash accounts allow Betterment to earn about % per dollar of AUM vs. % per dollar of AUM on their robo-advisor. With Betterment, you can pay as little as %. Premium has a % annual fee. That's a huge different compared to 2% – 3%!. In turn, this will save years off. $ monthly base fee, billed each calendar year annually ($1,) · +$6. monthly record-keeping fee per participant · +%. annual advisory fee. If you need help with educational planning, retirement planning, or marriage planning, you can schedule a call with CFP® professionals. No fee but must have. Depending on your account balance and certain other qualifications, you will pay a $4 per month subscription fee or an annualized % or % fee of your. Higher annual fee on larger portfolios — Betterment is $4 month with an automatic switch to % if certain factors are hit. The fee for Betterment Premium is. I love this debate! Let me add my 2 cents 1. On $K, you are looking at a $ fee at Betterment vs. a $ fee monthly fees. Upvote ·. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted. Checking accounts do not earn APY. Fees are taken right from your Betterment Investing account at the end of each month. No action is required on your part, and we'll never charge fees if you don. Cash back rewards on Betterment Checking purchases. Pricing. Betterment Investing – $4 monthly fee or % annual fee, Betterment Crypto – 1% + trading costs. Pro. $ per month + $6/monthly record keeping per active participant + % advisory fee + one-time implementation fee of $ for new plans, $1, With the basic account charging users% of the balance annually, Betterment remains one of the most affordable options on the market. You don't pay a fee. Most robo-advisors have few-to-no additional fees beyond the annual advisory fee, and the % Betterment charges for its Digital tier is the same as one of. Betterment · Trade commission fees: % to % · Account minimum: None for Digital account, $K for Premium · Consider it if: You want low fees, access to. With a Standard Membership at XYPN, your dream RIA is one affordable monthly fee away 20% off. Betterment Logo Provide a better investment experience. So some even have a flat fee structure, like they'll charge you $10 a month or $20 a month or whatever. But if you were like, okay, how does that really shake. In the past, the company's fees ranged from% to% of assets under management, depending on the size of a portfolio. The exception to this general rule.

Best Bundled Insurance

This discount is referred to as "bundling." Home and auto are a standard set of insurance policies to combine, but you can also receive bundle discounts on a. The logic behind insurance bundling is similar to the concept of buying in bulk: The more you purchase from a single company, the better the overall price you. At Liberty Mutual, we offer a discount for having your auto and home bundled. We also offer bundling savings when you combine your auto and other products. Save up to 20% when you bundle home and car insurance with Nationwide. Auto + renters. You're still eligible for a discount if you rent and need to insure a car. Member's Best is more than a home and auto bundle. Options like pet protection and roadside assistance allow your coverage to evolve—because your policy. Bundling insurance can make things simple by putting multiple types of coverages under one plan by one provider. It's a good idea on paper. State Farm offers the biggest home and insurance bundling discount with an average savings of 23% per year, according to our analysis. Has anyone gotten a good quote on a home and auto insurance bundle with multiple cars? bundled with my existing homeowner's insurance. By bundling your auto and home insurance together, you get better value and maximize your savings. With CAA Insurance, you also enjoy extra perks for bundling. This discount is referred to as "bundling." Home and auto are a standard set of insurance policies to combine, but you can also receive bundle discounts on a. The logic behind insurance bundling is similar to the concept of buying in bulk: The more you purchase from a single company, the better the overall price you. At Liberty Mutual, we offer a discount for having your auto and home bundled. We also offer bundling savings when you combine your auto and other products. Save up to 20% when you bundle home and car insurance with Nationwide. Auto + renters. You're still eligible for a discount if you rent and need to insure a car. Member's Best is more than a home and auto bundle. Options like pet protection and roadside assistance allow your coverage to evolve—because your policy. Bundling insurance can make things simple by putting multiple types of coverages under one plan by one provider. It's a good idea on paper. State Farm offers the biggest home and insurance bundling discount with an average savings of 23% per year, according to our analysis. Has anyone gotten a good quote on a home and auto insurance bundle with multiple cars? bundled with my existing homeowner's insurance. By bundling your auto and home insurance together, you get better value and maximize your savings. With CAA Insurance, you also enjoy extra perks for bundling.

Which Companies Offer Homeowners Insurance Bundling? · Amica · State Farm · Allstate · USAA · Nationwide · Erie Insurance · Lemonade · Chubb. Bundle your car and home insurance with us and save money. Manage We use cookies to personalize your content and make your digital experience better. You could save more, too, if you bundle your boat or motorcycle. “Bundling insurance policies also can simplify your bill paying and record-keeping,” Worters. Bundle your home and auto insurance and save! Get a quote today to determine your savings by joining USAA and bundling homeowners or renters with auto. Progressive makes it easy and affordable to bundle home and auto insurance and save with one company. When you bundle with us, you'll earn a multi-policy. bundle your home insurance with car insurance. We use cookies to deliver the best possible experience on our website and enable personalized advertising. Choose the Best Home Policy for You. Our Platinum Choice® Home policy offers: Additional protection up to 30% above your dwelling coverage limit if costs to. MoneyGeek found the best companies to bundle home and auto insurance policies. This could save you around $ per year and is nearly always the best. Benefits of Bundling your Insurance Policies. From protecting your car to your home, it's good to know you have the right insurance coverage for life's little. The best rates in Texas for residents looking to bundle home and auto insurance are from State Farm. See how much you can save on your insurance while bundling home and auto insurance with our comprehensive guide reviewed by our insurance experts. best rates for your coverage with the bundling discount. This is something that you would lose if you were to keep your insurance policies separate. How do. Best overall for auto and home — USAA While USAA was ranked best overall in The Zebra's Customer Satisfaction Survey, they specifically won top marks from. AAA Insurance has been insuring drivers for over years. Join the millions who already trust AAA Insurance. AAA logo. Peace of mind. When you bundle with AAA. As a broker, we search across a range of trusted insurance providers, to find the coverage that best fits your needs and budget. bundle their home and auto. Finding the right Auto and Homeowners Insurance policy can be difficult. All insurance companies claim to have the best policies, but you need coverage that is. Providing you with a great Multi-Policy Insurance Discount when you bundle your home and auto insurance is important to us. Our goal is to make sure you're. The Best Home and Auto Insurance Bundle Rates ; Liberty Mutual, Up to 3% ; State Farm, Up to 20% Saving for More Vehicles and 17% for Home ; Nationwide, Up to 20%. This is also referred to as a multi-line discount. It's the easiest way to get the greatest savings on your premiums. Auto and home insurance bundles are common. Bundle home and auto insurance policies with State Farm® and save up to Like a good neighbor, State Farm is there. ®. Contact. Contact Us · File a.