endcrypto.site Market

Market

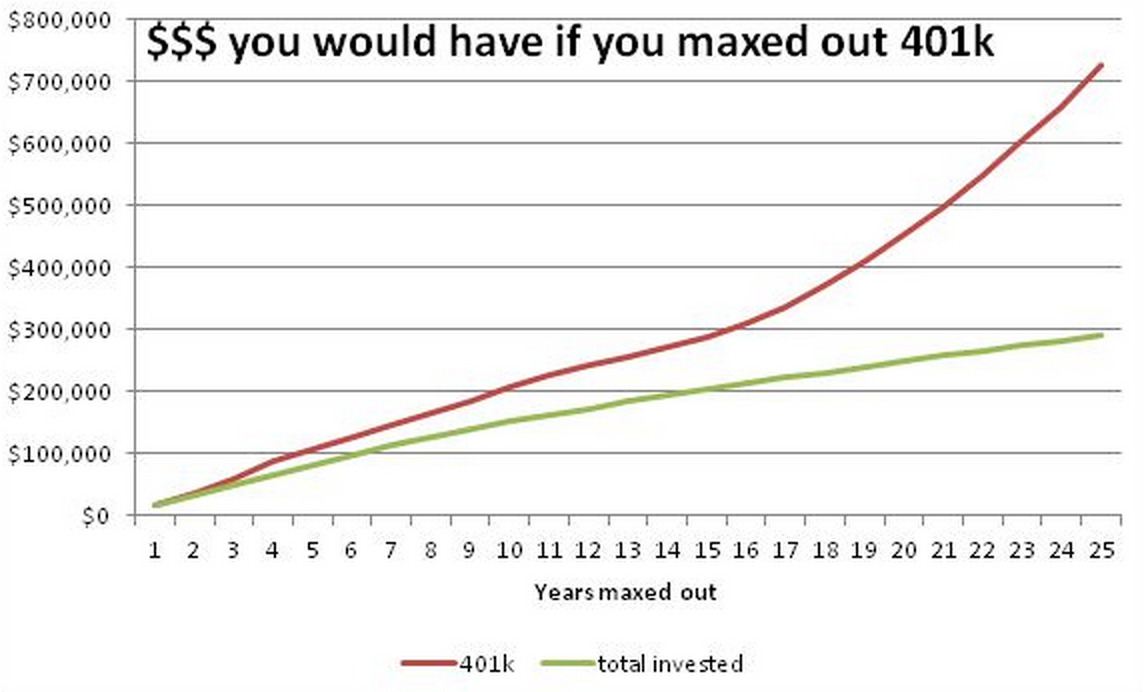

401k Calculator With Yearly Increase

Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. Employment Details →. Enter your age, current annual salary, pay frequency, expected salary increase every year and the age you want to retire. Free K calculator to plan and estimate a K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Historically, the year return of the S&P has been roughly 10–12%. Calculate. Your Results. Estimated Retirement Savings. In 0 years. Historically, the year return of the S&P has been roughly 10–12%. Calculate. Your Results. Estimated Retirement Savings. In 0 years. Annual income increase. Calculate. Retirement savings at age What you'll have. $, What you'll need. $1,, How did we calculate your results? A retirement savings program can be one of the best tools you can use for creating a secure retirement. One of the valuable features of many plans is. How does Titan's k calculator work? · Salary increase: This is how much your salary might increase each year. · Estimated Rate of Return: Rate of return (ROR). Use this retirement calculator to create your retirement plan. View your retirement savings balance and calculate your withdrawals for each year. Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. Employment Details →. Enter your age, current annual salary, pay frequency, expected salary increase every year and the age you want to retire. Free K calculator to plan and estimate a K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Historically, the year return of the S&P has been roughly 10–12%. Calculate. Your Results. Estimated Retirement Savings. In 0 years. Historically, the year return of the S&P has been roughly 10–12%. Calculate. Your Results. Estimated Retirement Savings. In 0 years. Annual income increase. Calculate. Retirement savings at age What you'll have. $, What you'll need. $1,, How did we calculate your results? A retirement savings program can be one of the best tools you can use for creating a secure retirement. One of the valuable features of many plans is. How does Titan's k calculator work? · Salary increase: This is how much your salary might increase each year. · Estimated Rate of Return: Rate of return (ROR). Use this retirement calculator to create your retirement plan. View your retirement savings balance and calculate your withdrawals for each year.

At what age do you want to retire? Annual income. Estimated annual salary increase. The average growth rate for a (k) is between 5% and 8%, depending on market conditions and the plan's asset allocation. The average annual return ranges from. It may surprise you how significant your retirement accumulation may become simply by saving a small percentage of your salary each month in your (k). 20, (or )=Current (k) Balance; 50, (or )=Current Annual Income; 3=Expected Annual Salary Increase; 6=Percent of Salary Withheld for (k) . The annual percentage you expect your salary to increase. The calculator assumes that your salary will continue to increase at this rate until you retire. insights into tax credits, annual fees, and more to make informed decisions about your retirement planning strategy Utilize the (k) calculator provided to. Use this calculator to see how increasing your contributions to a k can affect your paycheck and your retirement savings. Select a statePaycheck FAQs. Use this calculator to see how increasing your contributions to a (k) can affect your paycheck as well as your retirement savings. What is your current annual income? Please only enter numbers. On average, how much will your income increase annually? Please enter a number 0 - 0% Check this box if wish to have your annual contribution increased each year to keep up with inflation. If savings is tax-deferred checkbox: Check this box if. Use this calculator to estimate how much more you could accumulate while accounting for any employer match (if applicable). Use SmartAsset's (k) calculator to figure out how your income, employer matches, taxes and other factors will affect how your (k) grows over time. This calculator assumes that the year you retire, you do not If you increase your contribution to 10%, your annual contribution is $2, per year. Other k calculators require a lot of deceptive detail. This simple k savings calculator estimates your retirement investment growth and explains why. Impact of Inflation on Retirement Savings. Inflation is the general increase in prices and a fall in the purchasing power of money over time. The average. Calculating the future balance for each month until retirement · The value of the account is multiplied by , the monthly market growth effect. This is. The expected annual increase in your salary. We use this to project future contributions and matches to your savings plan. Year to date income: Income from your. You can also adjust the fields based on how much you plan to contribute to increase your savings. It's called retirement planning because you will need to. It may surprise you how significant your retirement accumulation may be simply by increasing Annual salary increases (0% to 10%) help. Plan Information. Estimated annual salary increase; Your contribution toward your (k); How old are you? At what age do you want to retire? What is your current.

Top Stocks To Watch Tomorrow

Our color-coded rankings quickly show you the sectors, industries, and stocks you should be buying and selling. Investing · 3 Cheap Oil Stocks To Buy In September · 3 Undervalued Stocks With At Least 50% Upside · 1 Growth Stock Down 16% That's Just Begging to Be Bought Right. Penny stock screener. Find the best penny stock companies with strong buy analyst ratings to buy today. Buy for a penny for the chance to leverage big gains. Get stock ideas and trading ideas from our research expert and identify the best investment opportunities. Today's hot stocks ; NVDA. - %. M ; TSLA. - %. M ; NIO. + %. M. Stock to buy today: Indian Overseas Bank (₹): BUY bl-premium-article-image · Stock to buy today: Astral (₹2,) · Stock to buy today: Hindalco Industries (₹. Find the best stocks to buy or sell today from our expert analysts. Get share recommendations along with target & stop loss and start trading with 5paisa. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. If you buy the top 5 largest food producers by market cap (currently Nestle Hi all, I received something from Vanguard in the mail today and I've never really. Our color-coded rankings quickly show you the sectors, industries, and stocks you should be buying and selling. Investing · 3 Cheap Oil Stocks To Buy In September · 3 Undervalued Stocks With At Least 50% Upside · 1 Growth Stock Down 16% That's Just Begging to Be Bought Right. Penny stock screener. Find the best penny stock companies with strong buy analyst ratings to buy today. Buy for a penny for the chance to leverage big gains. Get stock ideas and trading ideas from our research expert and identify the best investment opportunities. Today's hot stocks ; NVDA. - %. M ; TSLA. - %. M ; NIO. + %. M. Stock to buy today: Indian Overseas Bank (₹): BUY bl-premium-article-image · Stock to buy today: Astral (₹2,) · Stock to buy today: Hindalco Industries (₹. Find the best stocks to buy or sell today from our expert analysts. Get share recommendations along with target & stop loss and start trading with 5paisa. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. If you buy the top 5 largest food producers by market cap (currently Nestle Hi all, I received something from Vanguard in the mail today and I've never really.

TOP ; SBAC · SBA Communications Corp. % ; CCI · Crown Castle Inc. % ; UAL · United Airlines Holdings Inc. %. LIVE: Stocks to Watch Today ; MAZAGON DOCK SHIP. 4,, ; INDIAMART INTERMESH, 2,, ; GLAND PHARMA, 1,, ; OLECTRA GREENTECH, 1, Best meme stocks: top trending shares on Reddit · AMC Entertainment · GameStop · BlackBerry · S&P · Nvidia · Tesla · Carvana · Super Micro Computer. Top 20 Gainers/ Losers ; HINDUNILVR, 2,, 2, ; BRITANNIA, 5,, 5, ; HEROMOTOCO, 5,, 5, ; TATASTEEL, , Top Dividend Stocks · #1. Voya Financial Inc (VOYA) · #2. Diamondback Energy Inc (FANG) · #3. Mosaic Company (MOS). Pick the best stocks to buy and optimize your portfolio with the power of our AI. Get unbiased and unique insights, and make smart data-driven investment. stocks to buy tomorrow intraday NSE. Stocks going UP tomorrow · Advani Hotels · Ducon Tech · Indiabulls Ent · Nrb Industrial · Yaari Digi. Today End Of Year. Type: Bullish Bearish. APPLY FILTER. Pub Date, % Change Since It is always a good idea to look for stocks that are set up for. Find the best ChatGPT stocks to buy now with the highest Smart Score. Compare top growth companies and stocks today by price, analysts ratings, and more. Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data. How does Nasdaq define the "Ten Most Advanced" and ". Stocks To Watch Tomorrow ; ZETA, ; SMAR, ; ROIV, ; BAX, UnitedHealth, Emerson Electric and Microsoft top the list of stocks scoring rare Strong Buy consensus ratings. Some of the other names might surprise you. Moneycontrol do in-depth research and analyze the stock market and picks stocks which have the best momentum. LIVE: Stocks to Watch Today ; MAZAGON DOCK SHIP. 4,, ; INDIAMART INTERMESH, 2,, ; GLAND PHARMA, 1,, ; OLECTRA GREENTECH, 1, Log in to view the top rated stocks in each sector, based on the Equity Summary Score. The Equity Summary Score provides a consolidated view of the ratings. Best Stocks to Day Trade · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · Tesla Inc. (TSLA) · Marathon Digital Holdings (MARA) · GameStop Corp. (GME). US stocks that increased the most in price ; AGX · D · +%, USD, M · ; JJBDI · D · +%, USD, K · —. Time to Buy These Top Insurance Stocks Amid Heightened Market Volatility · Top today. MENU. Prev Next. My portfolio module loader. More Zacks Resources. Buying stocks under $10 is not for the faint of heart. Many of these stocks are extremely volatile and high-risk speculative investments, but some diamonds. Stock Movers ; ALBT · Avalon Globocare ; AVGX · Defiance Daily Target 2X Long AVGO ETF ; PTWOU · Pono Capital Two ; INBS · Intelligent Bio Solutions.

Pos System On Phone

Mobile POS System a Mobile POS Systems part of Discontinued | With the endcrypto.site Mobile POS System, you gain the freedom of movement unseen with a. An affordable, fully mobile POS solution that lets you run your business using your smartphone or tablet devices. Discover how Vital mobile is ideal for. Square Point of Sale is a free point-of-sale app that enables you to sell anywhere and in any way your customers want to buy. Start taking payments in minutes. Take control of your business with powerful and portable Android point of sale (POS) systems designed with retail and hospitality businesses in mind. eHopper is the mobile POS system built for small businesses. Manage your customers, employees and business from a Windows or Android tablet or Poynt device. Meet the next generation of Point-of-Sale (POS) technology. From traditional mobile POS, which still relies on hardware to software-based solutions like Tap on. Take orders online or over the phone, and manage pickup and delivery directly in the POS system. Connected hardware. Sync with Square hardware for easy. MPOS, or mobile point-of-sale, is a smartphone, tablet or dedicated wireless device that performs the functions of a cash register or electronic POS terminal. Step 1: To build an Android-Based POS System · Get an off-the-shelf Android tablet with a 7” or 10” screen size. · Get a credit card reader for processing. Mobile POS System a Mobile POS Systems part of Discontinued | With the endcrypto.site Mobile POS System, you gain the freedom of movement unseen with a. An affordable, fully mobile POS solution that lets you run your business using your smartphone or tablet devices. Discover how Vital mobile is ideal for. Square Point of Sale is a free point-of-sale app that enables you to sell anywhere and in any way your customers want to buy. Start taking payments in minutes. Take control of your business with powerful and portable Android point of sale (POS) systems designed with retail and hospitality businesses in mind. eHopper is the mobile POS system built for small businesses. Manage your customers, employees and business from a Windows or Android tablet or Poynt device. Meet the next generation of Point-of-Sale (POS) technology. From traditional mobile POS, which still relies on hardware to software-based solutions like Tap on. Take orders online or over the phone, and manage pickup and delivery directly in the POS system. Connected hardware. Sync with Square hardware for easy. MPOS, or mobile point-of-sale, is a smartphone, tablet or dedicated wireless device that performs the functions of a cash register or electronic POS terminal. Step 1: To build an Android-Based POS System · Get an off-the-shelf Android tablet with a 7” or 10” screen size. · Get a credit card reader for processing.

IOResource stocks a great selection of mobile POS, including handheld terminals from brands like Urovo. Use them to easily scan codes and print receipts. Key Features to Look for in an Android POS System · Payment processor · Inventory management · Sales reporting and analytics · Customer management · Employee. eHopper is an easy to use touchscreen POS available for Android-based tablets. You can manage business operations efficiently, process transactions and assist. EPAY Mini POS Mobile POS | Credit Card Machine to Accept All Payments | Bars, Retail, Salons and Service Businesses. Process payments Trough Envision Processing. Some of the top mPOS systems for small businesses in include Square, Clover, PayPal Zettle, Toast, TouchBistro, Revel Systems, and Shopify. These systems. Square Point of Sale is a free point-of-sale app that enables you to sell anywhere and in any way your customers want to buy. Start taking payments in minutes. Hike combines functionality with mobility, allowing you to sell-on-the-go with our powerful mobile POS system. From food-trucks to multi-chain retail stores. Mobile POS systems: These are POS systems that use a mobile device, such as a smartphone or tablet, as the main point of sale terminal. · Handheld POS systems. SalesPlay helps you to transform your smart device into a free POS software. Manage sales, inventory, and employees with ease and build a loyal customer. Mobile POS systems can improve restaurant payments, turning devices into mobile registers. They can also generate reports and help with inventory. mPOS systems enable business owners to transact anywhere on a mobile network or Wi-Fi. They offer customers flexibility. And they come with many powerful. Simple, Effective, All-In-One Repair Store Management Software. Track Repair Jobs, Mobile Devices, Customers, Inventory and more. Just $39USD/mo. Mobile POS System: Streamlining Business with eMobilePOS. eMobilePOS, your versatile mobile POS solution, effortlessly transforms smartphones and tablets into. Your cellphone shop needs a POS system. From tracking sales to cashing out Setting up is so simple, your Mobile Phone Shop could be making sales today! Mobile POS gives servers real-time updates on order status, item availability and menu changes, preventing confusion and last-minute surprises. Female. A mobile POS can help you bust lines, showcase more items to shoppers, and help your staff recall product details on the sales floor. A cloud-based system. With the Table needs Mobile POS System, you can manage orders and tickets, update menus, and access reports right from your phone or tablet. Mobile POS, or Mobile Point of Sale, systems are the next evolutionary step in transaction processing technology. These systems embody the convergence of. Using your own Apple or Android device with a mobile card reader creates a great mobile point of sale (mPOS) solution. LithosPOS solution provides POS software for hardware stores and mobile stores, by implementing the POS system into your cell phone store or electronic shop.

Is It Easier To Refinance With Current Lender

Bear in mind, refinancing a loan is a lot less risky than writing a new loan. When you refi someone, you can see that they have a payment. It's crazy-easy to start your refinance mortgage process. Start an If you have a few years left on your current mortgage term, your lender may. It could be easier to refinance with the same lender since you already have an established relationship. The company has your information on file, including. You do not need to refinance with the same lender as the original loan. You can turn to a mortgage broker to find the best refinancing rate. Once your. Refinance loans are easier to shop than purchase loans because refinancing Indeed, a borrower refinancing with any lender other than his current lender. Mortgage refinancing is the act of paying off an existing mortgage with a brand new one. Homeowners do this to take advantage of a lower interest rate. Sometimes, it is best to refinance with your current lender, particularly if you already have a positive borrower-lender relationship with them. There are lots of options, but in some cases, you may actually benefit from refinancing with your current lender. A small group of borrowers might profit from refinancing with their current lenders, but most borrowers will do better refinancing with a new lender. Bear in mind, refinancing a loan is a lot less risky than writing a new loan. When you refi someone, you can see that they have a payment. It's crazy-easy to start your refinance mortgage process. Start an If you have a few years left on your current mortgage term, your lender may. It could be easier to refinance with the same lender since you already have an established relationship. The company has your information on file, including. You do not need to refinance with the same lender as the original loan. You can turn to a mortgage broker to find the best refinancing rate. Once your. Refinance loans are easier to shop than purchase loans because refinancing Indeed, a borrower refinancing with any lender other than his current lender. Mortgage refinancing is the act of paying off an existing mortgage with a brand new one. Homeowners do this to take advantage of a lower interest rate. Sometimes, it is best to refinance with your current lender, particularly if you already have a positive borrower-lender relationship with them. There are lots of options, but in some cases, you may actually benefit from refinancing with your current lender. A small group of borrowers might profit from refinancing with their current lenders, but most borrowers will do better refinancing with a new lender.

Bank of America: Best overall. · Better: Best for online-only applications. · SoFi: Best for minimum equity requirements. · Ally: Best for no lender fees. · Chase. Lower your mortgage rate. If mortgage rates are lower than when you closed on your current mortgage, refinancing could reduce your monthly payments and the. You can also eliminate your PMI with as little as 5% equity on your home by refinancing to a conventional loan with lender paid mortgage insurance (LPMI) which. If you're interested in swapping your current home loan for one with a lower rate, different amount or better terms, a mortgage refinance may be the right. In most cases the answer is no. Every state in the US has different fees when doing a refinance, so always get an e from your lender. Why refinance? Refinancing your home can offer better terms, lower payments, or added cash for projects. · How can I refinance? Each lender might have different. Mortgage refinancing is a term that intimidates some homeowners, but don't worry — your mortgage lender is here to educate you and provide the necessary support. Yes. You don't have to refinance your mortgage with your current lender. You can compare and shop for the mortgage lender that best suits your financial. 75% may make it well worth your while to refinance. You can expect to pay from 2% to 5% of a loan's principal in closing costs. Your lender may also require an. Home loan refinancing is an easy process, especially if you refinance with your current lender. However, it always makes sense to shop for the best (lowest). You can refinance with any lender, including your current lender. Apply to multiple lenders for a refinance, obtain loan estimates in writing, and compare the. As with your current mortgage, you will work with a lender through all stages of the refinance process. Whether it is the same lender or a new one is up to you. Minimum down payment Plus, the refinancing process can be relatively easy with lenders who offer a virtual experience. In addition to Rocket Mortgage, Better. When you refinance, you're taking out a new loan to pay off and replace your current mortgage, which means you'll need to qualify all over again. Each lender. You may be able to use this equity to borrow money, but is it better to get a second mortgage or refinance? current debt, your credit score and your lender. You'll need to know your current credit score. Mortgage refinance lenders have tightened their standards for loan approvals in recent years. Some consumers may. If you have 20 years left on your mortgage, you could refinance to a 15 year mortgage and own your home five years sooner. Change Your Loan Type. See today's refinance rates. Browse and compare current refinance rates for various home loan products from U.S. Bank lender. The APR may be increased. Is It Better to Refinance With Your Current Lender? You can refinance with your current mortgage company if you're happy with its service and it offers a. When you refinance your mortgage, you replace your existing mortgage with a new one on different terms. To find out if you qualify, your lender calculates your.

How Long Can You File Back Taxes

Use Where's My Refund to check the status of individual income tax returns and amended individual income tax returns you've filed within the last year. Penalties for Past Due Taxes · If you are paying the tax days late, add a 5% penalty. · If you are paying the tax over 30 days late, add a 10% penalty. · If. The Canada Revenue Agency is usually only able to review your tax returns within three years beyond the date they were originally filed or due. In such cases, the tax return must be filed by the next business day after April 15th. Example If a calendar year taxpayer dies on Aug. 15th, then his or her. Paper returns or applications for tax refunds are processed within 8 to 12 weeks. If sufficient time has passed for your return to be processed, and you are. If you don't qualify for free tax filing software, you can still file your As soon as we've processed your return, your refund will be deposited. If you filed with FreeTaxUSA, you can access and print your returns for the past seven years. Print Prior Year Returns. Request Copy From IRS. If you aren't a. Learn why you should file your taxes, the federal benefits tied to personal income tax returns and penalties for filing late. Call for help What happens if you file taxes late? A failure to file penalty is charged on tax returns with a balance due filed after the due date (Tax Day) or extended due. Use Where's My Refund to check the status of individual income tax returns and amended individual income tax returns you've filed within the last year. Penalties for Past Due Taxes · If you are paying the tax days late, add a 5% penalty. · If you are paying the tax over 30 days late, add a 10% penalty. · If. The Canada Revenue Agency is usually only able to review your tax returns within three years beyond the date they were originally filed or due. In such cases, the tax return must be filed by the next business day after April 15th. Example If a calendar year taxpayer dies on Aug. 15th, then his or her. Paper returns or applications for tax refunds are processed within 8 to 12 weeks. If sufficient time has passed for your return to be processed, and you are. If you don't qualify for free tax filing software, you can still file your As soon as we've processed your return, your refund will be deposited. If you filed with FreeTaxUSA, you can access and print your returns for the past seven years. Print Prior Year Returns. Request Copy From IRS. If you aren't a. Learn why you should file your taxes, the federal benefits tied to personal income tax returns and penalties for filing late. Call for help What happens if you file taxes late? A failure to file penalty is charged on tax returns with a balance due filed after the due date (Tax Day) or extended due.

Avoiding filing taxes for a year is one thing, but what happens if you delay for much longer, for ten years? No matter how long it's been since you filed, it's. Several software companies offer FREE e-file services to qualified Michigan taxpayers. If you do not qualify to file for FREE, you may also e-file for a small. The IRS tax refund process. The IRS follows a very detailed process when handling tax returns and issuing tax refunds. If you're filing electronically, the. The general recommendation is to keep your returns and any supporting documents for three years after you file or the tax return due date, whichever is later. If you owe back taxes, you must file a past-due return with the IRS. Although the process is similar to filing an on-time tax return, there are a few things to. Remember: No matter what method you choose, your income tax return is due April 15, If you choose to file a paper return, you can use our Tax Form. You may still be able to claim a refund if you file late—but you typically have to do so within 3 years of when your tax return was originally due. The IRS may. tax returns you've filed within the last year. Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount. If. You can have your refund direct deposited into your bank account. Proof of Filing. An acknowledgment is issued when your return is received and accepted. Delinquent Tax · If you enter into a payment plan with the department: You are charged a $20 fee · Can't pay the full amount owed with your tax return? File your. Then file your tax returns for each year. Never filed taxes before? It's okay. All you need to determine which tax years you need to file. The IRS generally. long as you file the return on the next succeeding day which is not a Saturday A copy of the tax return you filed in another state or country if you. If your return or payment is late and you feel you have a qualifying situation, you may request to have the penalty waived. Delinquent tax collection process. You must wait 3 days (72 hours) after filing before updating your return. Sign in to your account. From 'Your tax account', choose 'Self Assessment account'. You can start filing taxes in mid-February, and the deadline is typically the end of April. If you're self-employed, the deadline to file your taxes is. There are several ways you can file your personal or business income tax returns on paper or electronically. If you are a Maryland resident, you can file long. How many years can I go back and file for a refund? You have 3 years from the You do not need to file a Mississippi Individual Income Tax return if you. Simply filing the return late can result in a “failure to file” penalty. If you owe tax on those returns, but did not pay prior to April 15 of the following. As per Section of the Income Tax Act, if you fail to file your tax returns, it can result in a fine of $1, to $25, Plus, you will also face up to one. Back to Top. How many years can I go back and file for a refund? You have 3 years from the due date of the original tax return to file for a refund.. Back to.

How Much Will A Financial Advisor Cost

Most financial advisors charge a fee based on a fixed percentage of the total value of your investment portfolio. The industry-average is 1% of your portfolio. Trades placed through a Schwab Alliance or Schwab Investor Services representative will be charged an additional $25 broker-assisted fee and will be subject to. For simple suggestions and general oversight, an advisor may charge between $1, to $2, A greater level of service will warrant higher fixed fees or a. According to Advisor Ratings, the average cost of a financial advisor is about $3, As with any profession, this can increase to upwards of $30, depending. 88% (the industry average for a $3,, portfolio). That is $26, per year out of your pocket (or, more likely, your investment portfolio). Fast forward a. We are compensated by asset-based fees. However, cost paid for asset management are included in many of our financial planning services. Different tiers of. How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. There is no minimum investment for a Select Account; however, some investments in Select accounts require minimum purchase amounts. In an Edward Jones Select. The cost of business financial planning ranges between $90 and $ per hour, with an average cost of $ per hour. There is a large variation in. Most financial advisors charge a fee based on a fixed percentage of the total value of your investment portfolio. The industry-average is 1% of your portfolio. Trades placed through a Schwab Alliance or Schwab Investor Services representative will be charged an additional $25 broker-assisted fee and will be subject to. For simple suggestions and general oversight, an advisor may charge between $1, to $2, A greater level of service will warrant higher fixed fees or a. According to Advisor Ratings, the average cost of a financial advisor is about $3, As with any profession, this can increase to upwards of $30, depending. 88% (the industry average for a $3,, portfolio). That is $26, per year out of your pocket (or, more likely, your investment portfolio). Fast forward a. We are compensated by asset-based fees. However, cost paid for asset management are included in many of our financial planning services. Different tiers of. How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. There is no minimum investment for a Select Account; however, some investments in Select accounts require minimum purchase amounts. In an Edward Jones Select. The cost of business financial planning ranges between $90 and $ per hour, with an average cost of $ per hour. There is a large variation in.

Financial advisor fees are charges you pay for professional advice and management of your financial planning and investment portfolio. These fees can vary. It is important to note, that a substantial number of financial planners charged more than 1% for clients with less than $, The median fee for $, Financial Advisors Are Part of the Problem Financial advisors often charge an Assets Under Management (AUM) fee - usually 1%. That means you pay your advisor. How Much Does a Fee-Only Financial Advisor Cost? A study from Kitces finds that the average hourly fee for a fee-only advisor is $ in (up from. The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the. Are you wondering if an hourly fee financial advisor is right for you? A growing number of financial advisors work on an hourly basis, with prices ranging. Advisers usually receive commissions for insurance policies. You can ask to pay a higher up-front fee to your adviser to reduce the commission and your premium. How you pay is broadly based on the types of services we provide: investment advisory (percentage of assets held in your account), brokerage (sales charge on. A stand-alone financial plan may run $1, to $3, An annual flat fee may be as much as $7,, and hourly rates range from $ to $ It is important to. A registered investment advisor for Client B charges 1% for his services and purchases institutional shares of the same fund with an operating expense of %. How much does a financial advisor cost? The fees charged by financial advisors vary depending on several factors. These factors include their business model. How much does it cost to work with an Ameriprise financial advisor? Each relationship with a new client begins with a complimentary consultation where you. Usually we see this when a client comes to us after working with an advisor from a wirehouse or a large brokerage firm. When they show us their portfolios. As the name suggests, an hourly rate financial advisor charges clients based on the time they spend providing financial advice and services. They can be ideal. Industry studies estimate that professional financial advice can add up to % to portfolio returns over the long term, depending on the time period and how. A fee-only financial advisor might charge a flat fee, normally from $1, to $5, They may charge hourly fees of $ to $, or a percentage fee, normally. Fee-only financial planners are financial planners who receive payment for their advisory services only in the form of fees paid by their clients for their. Further, a Registered Investment Advisor must explain upfront how they receive compensation. Fees range but generally average somewhere between % of the. Costs Of Hiring A Financial Advisor · Percentage of Assets Managed: Advisors may charge between % to 2% of your managed assets annually. · Flat Fees. Vanguard Personal Advisor charges Vanguard Brokerage Accounts an annual gross advisory fee of % for its all-index investment options and % for an active.

What Are The 2021 Federal Income Tax Brackets

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as. Tax rates for previous years are as follows: For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, The remaining amount would be taxed at per cent, which comes out to $1, In total, that employee paid $9, in federal tax. In , the first. tax tables furnished by the Louisiana Department of Revenue. The tax Resident taxpayers who are required to file a federal individual income tax return. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. For tax year , Maryland's personal tax rates begin at 2% on the first Income Tax Alert – Impact of Federal Student Loan Forgiveness on Maryland. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as. Tax rates for previous years are as follows: For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, The remaining amount would be taxed at per cent, which comes out to $1, In total, that employee paid $9, in federal tax. In , the first. tax tables furnished by the Louisiana Department of Revenue. The tax Resident taxpayers who are required to file a federal individual income tax return. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. For tax year , Maryland's personal tax rates begin at 2% on the first Income Tax Alert – Impact of Federal Student Loan Forgiveness on Maryland. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17,

Tax Year Vermont Rate Schedules · Vermont Tax Tables. Tax Year Contact Us. Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff. Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). The rates apply to taxable income—adjusted gross income. Schedule P, Kentucky Pension Income Exclusion. For all individuals who are retired from the federal government, the Commonwealth of Kentucky, or a Kentucky. Tax Brackets & Rates ; , , ; 10%, 0 – $9,, 10%, 0 – $9,, 10%. Round to the nearest whole dollar and enter on Form MO, Line 28Y and 28S. Section B. Section A. Tax Rate Chart. Tax Calculation Worksheet. Yourself. Spouse. Example: Chris and Pat Smith are filing a joint tax return using Form Their taxable income on Form , line 19 is $, Step 1: Using Schedule Y. Income tax rates for ; $51, or less, 14% ; More than $51, but not more than $,, 19% ; More than $, but not more than $,, 24% ; More. Federal Tax Rates · Tax bracket rate: The current year tax brackets range from 10% to 37%. · Marginal tax rate: The marginal tax rate is the percentage number of. Ordinary income is considered all taxable income that is not a net long-term capital gain. The tax tables are found here. In , the top marginal tax. Tax Brackets ; Tax Rate, Single Filers, Married Filing Jointly, Heads of Household ; 10%, up to $9,, up to $19,, up to $14, ; 12%, $9, to $40, Wages, salary or tips where federal income taxes are withheld on Form W-2, box 1 Find the maximum AGI, investment income and credit amounts for tax year There are seven tax rates in effect for both the 20tax years: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year, the tax. To calculate the Colorado income tax, a “flat” tax rate of percent is applied to federal taxable income after adjusting for state additions and. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Source: IRS Revenue Procedure Table 4. Personal Exemptions Statutory Marginal Income Tax Rates, Joint Returns. If taxable income is. How Federal Income Tax Brackets Work · The first $10, will be taxed at 10% resulting in a tax of $1, · The next $31, ($41,$10,) will be taxed. Graph and download economic data for U.S Individual Income Tax: Tax Rates for Regular Tax: Highest Bracket (IITTRHB) from to about individual, tax. Source: IRS Revenue Procedure Table 4. Personal Exemptions Statutory Marginal Income Tax Rates, Joint Returns. If taxable income is. If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows: Please contact us at or taxmaster@utah.

Can I Open 2 Checking Accounts At The Same Bank

There are no laws against having more than one business bank account and the pros out weigh the cons. Can You Have Two Checking Accounts At The Same Bank. In most cases, you can definitely have two checking accounts at the same bank. This. Discover our chequing accounts with unlimited transactions, free Interac e-Transfer transactions or low monthly fees. Open a TD chequing account online. 1 Account available for students 10 to 25 years old at account opening. · 2 ATM surcharges will be automatically rebated for any other bank-owned and operated. A savings, checking, Equity Flexline, or credit card account may provide Overdraft Protection to multiple checking accounts. At least one owner of the account. You might decide that a checking or savings account is the right product for you. If you do, opening an account at a bank or credit union is straightforward. Yes, You can have two accounts in a bank: In two different branches or at the same branch. You will have to let them know the purpose of second. Can I receive multiple monthly fee rebates on the same bank account? No, you can only receive one monthly fee rebate per bank account. For example, you. Multiple bank accounts can help you organize your money, set goals and earn interest. Some banks also reward customers for having several accounts by waiving. There are no laws against having more than one business bank account and the pros out weigh the cons. Can You Have Two Checking Accounts At The Same Bank. In most cases, you can definitely have two checking accounts at the same bank. This. Discover our chequing accounts with unlimited transactions, free Interac e-Transfer transactions or low monthly fees. Open a TD chequing account online. 1 Account available for students 10 to 25 years old at account opening. · 2 ATM surcharges will be automatically rebated for any other bank-owned and operated. A savings, checking, Equity Flexline, or credit card account may provide Overdraft Protection to multiple checking accounts. At least one owner of the account. You might decide that a checking or savings account is the right product for you. If you do, opening an account at a bank or credit union is straightforward. Yes, You can have two accounts in a bank: In two different branches or at the same branch. You will have to let them know the purpose of second. Can I receive multiple monthly fee rebates on the same bank account? No, you can only receive one monthly fee rebate per bank account. For example, you. Multiple bank accounts can help you organize your money, set goals and earn interest. Some banks also reward customers for having several accounts by waiving.

Visit to open a new TD bank checking account online in minutes! Find the right bank account for your budget, the perks you want and get online banking. Apply online and access your bank account instantly. You can also add your debit card to your mobile wallet and start shopping on the first day. Visit to open a new TD bank checking account online in minutes! Find the right bank account for your budget, the perks you want and get online banking. Minimum Amount To Open. $ · Monthly Service Charge. $ · Minimum Daily Balance. No Minimum Required · Do I Earn Interest? No. No need to visit a branch. If you already have an existing deposit account or credit card, you can open an additional account using Scotia OnLine Banking. I assumed it would be simple but I don't see any way to add a second bank account. When I select "card details" from apple cash I see my bank account but. Four great checking options to choose from. Whether you're looking for no monthly maintenance fees, an interest-earning account, or perks like credit score and. You can use your chequing account to conduct the following transactions: Deposits (cash and cheques), withdraw money (at ATMs, bank tellers, etc.), one-time. 1. An NSF/Overdraft fee will not be charged to an account if the ending daily balance in the account is overdrawn by $ or less. · 2. Senior Perks can be. Compare Old National checking accounts. Find the option for your needs. Accounts include online and mobile banking. You can open your checking account. Some banks offer incentives or preferential services for customers with multiple accounts. This could include waived fees, higher interest rates on deposits, or. How to open a joint bank account Accounts can be opened in person at a branch office or online, depending on the bank you choose. If you plan to do it in. Some people opt to open multiple accounts at more than one bank because doing so makes it easier for them to budget for long-term goals. For example, if you're. The essential account for feeling confident about your money. 24/7 customer support; $ overdraft grace; Access to direct deposits up to two days earlier. All owners can withdraw cash, write checks, and make online payments. Key Takeaways: A joint account is a bank or brokerage account shared by two or more. Having multiple accounts in a savings portfolio along with a checking account can get confusing but keeping your accounts at the same bank can provide. Two women and one man sitting at a table with food with farm chic decor looking. Mobilize Your Money. Send and Receive Money with Zelle®. Welcome to a world. Accounts are not automatically linked. Please notify your banker which accounts should be linked. If the Premier Checking account is closed for any reason, or. Can You Have Two Checking Accounts At The Same Bank. In most cases, you can definitely have two checking accounts at the same bank. This. Take control with IBC Bank's various personal checking account types for every You can easily get started with a $10 opening deposit! Unlimited.

How Many Calories Are In Vanilla Sweet Cream Cold Foam

And as a reminder, as a dietitian, all drinks and fun can fit in. But let's be real, making many of these drinks lower calorie. and lower in sugar have health. Shop for Starbucks Cold Brew Vanilla Sweet Cream at endcrypto.site Save money. Live better. Vanilla Sweet Cream Cold Foam: Approximately calories. Coffee or Cold Brew (without additional flavorings or sweeteners): Typically. A Starbucks Grande Vanilla Sweet Cream Cold Brew contains calories, 6 grams of fat and 14 grams of carbohydrates. Keep reading to see the full nutrition. Vanilla Sweet Cream Cold Brew ; Calories ; Calories from Fat50 ; 5 · % ; 15 mg5% ; 20 mg1%. K Likes, Comments. TikTok video from themacrobarista (@themacrobarista): K. Vanilla bean and Caramel Cold brew. Nutrition Information and Calories ; Nonfat Vanilla Sweet Cream Cold Foam: 25 calories (2 tbsp) ; Salted Caramel Cream Cold Foam: 50 calories (2. Starbucks Ca Beverages Coffee Vanilla Sweet Cream Cold Brew Venti ( ml) contains 24g total carbs, 24g net carbs, 11g fat, 1g protein, and calories. There are 45 calories in cup of Vanilla Sweet Cream Cold Foam from: Carbs 7g, Fat g, Protein 1g. Get full nutrition facts. And as a reminder, as a dietitian, all drinks and fun can fit in. But let's be real, making many of these drinks lower calorie. and lower in sugar have health. Shop for Starbucks Cold Brew Vanilla Sweet Cream at endcrypto.site Save money. Live better. Vanilla Sweet Cream Cold Foam: Approximately calories. Coffee or Cold Brew (without additional flavorings or sweeteners): Typically. A Starbucks Grande Vanilla Sweet Cream Cold Brew contains calories, 6 grams of fat and 14 grams of carbohydrates. Keep reading to see the full nutrition. Vanilla Sweet Cream Cold Brew ; Calories ; Calories from Fat50 ; 5 · % ; 15 mg5% ; 20 mg1%. K Likes, Comments. TikTok video from themacrobarista (@themacrobarista): K. Vanilla bean and Caramel Cold brew. Nutrition Information and Calories ; Nonfat Vanilla Sweet Cream Cold Foam: 25 calories (2 tbsp) ; Salted Caramel Cream Cold Foam: 50 calories (2. Starbucks Ca Beverages Coffee Vanilla Sweet Cream Cold Brew Venti ( ml) contains 24g total carbs, 24g net carbs, 11g fat, 1g protein, and calories. There are 45 calories in cup of Vanilla Sweet Cream Cold Foam from: Carbs 7g, Fat g, Protein 1g. Get full nutrition facts.

Vanilla Sweet Cream Cold Brew ; Calories ; Calories from Fat50 ; 5 · % ; 15 mg5% ; 20 mg1%.

Try it sugar-free or infused with any of our flavored syrups. Nutrition varies by syrup. Sweet Cream shown below (nutrition shown is for Cold Foam only). If you're short on time, here's a quick answer to your question: A grande Starbucks vanilla cold foam has about 60 calories. The fat content is grams and. Our light and frothy Cold Foam is crafted from a blend of 2% milk and a rich cream base, and can be customized with any flavor to fluff up your drink! Then divide that by 20 to get the amount used for the Vanilla Sweet Cream Cold Foam which is Calories approximately. Results will vary. Cold Brew with Nondairy Vanilla Sweet Cream Cold Foam ; Calories ; Calories from Fat80 ; 8 · % ; 35 mg2% ; 19 · %. Cold Brew with Nondairy Vanilla Sweet Cream Cold Foam ; Calories ; Calories from Fat80 ; 8 · % ; 35 mg2% ; 19 · %. * Percentage of Daily Values are based on a 2, calorie diet. Ingredients: cold-brewed starbucks coffee (water, coffee), reduced. Made with real cream and natural vanilla flavor, this modern twist on regular whipped cream adds a bold, sweet twist to your hot or iced coffee. Here are a few of our favorite drinks that we hand-crafted and topped with our rich & fluffy, Sweet Foam! Sweet Foam Caramel Cold Brew. Sweet. Premium coffee drink. Vanilla sweet cream flavored with other natural flavors. calories per bottle. Cold brewed, super-smooth. Calorie Burn Time. How long would it take to burn off Calories of Starbucks Vanilla Sweet Cream Cold Brew Coffee? There are 53 calories in 1 tall, 12 endcrypto.site (12 fl. oz) of Starbucks Vanilla Sweet Cream Nitro Cold Brew. You'd need to walk 15 minutes to burn 53 calories. Nutrition Facts ; Fat · ; mg ; Carbohydrates · ; 11g ; Protein · g. Made from real grade-A cream and nonfat milk, this lightly sweet, easy-to-use topper delivers a touch of rich, velvety cream with every sip. Made with real cream and natural vanilla flavor, this modern twist on regular whipped cream adds a bold, sweet twist to your hot or iced coffee. calories, 18g sugar, 8g fat. Full nutrition & ingredients list. Similar How much does Cold Brew with Nondairy Vanilla Sweet Cream Cold Foam cost? Product details Flavored with other natural flavors. calories per bottle. Starbucks Colombian blend. Super-smooth cold brew coffee: We started. Caramel Brûlée Cold Foam Cold Brew ~~~~~Approximate Macros~~~~~ Protein: 1g/ Carbs: 14g/Fat:1g SUGAR: 13g Fiber: 1g Caffeine: ~mg ‼️ There are 83 calories in 1 tall (12 fl. oz) of Starbucks Iced Vanilla Sweet Cream Cold Brew Coffee. You'd need to walk 23 minutes to burn 83 calories. I make this many mornings when I am feeling like a sweet cream vanilla coffee! Super simple to put together and I honestly like this more than the Starbucks.

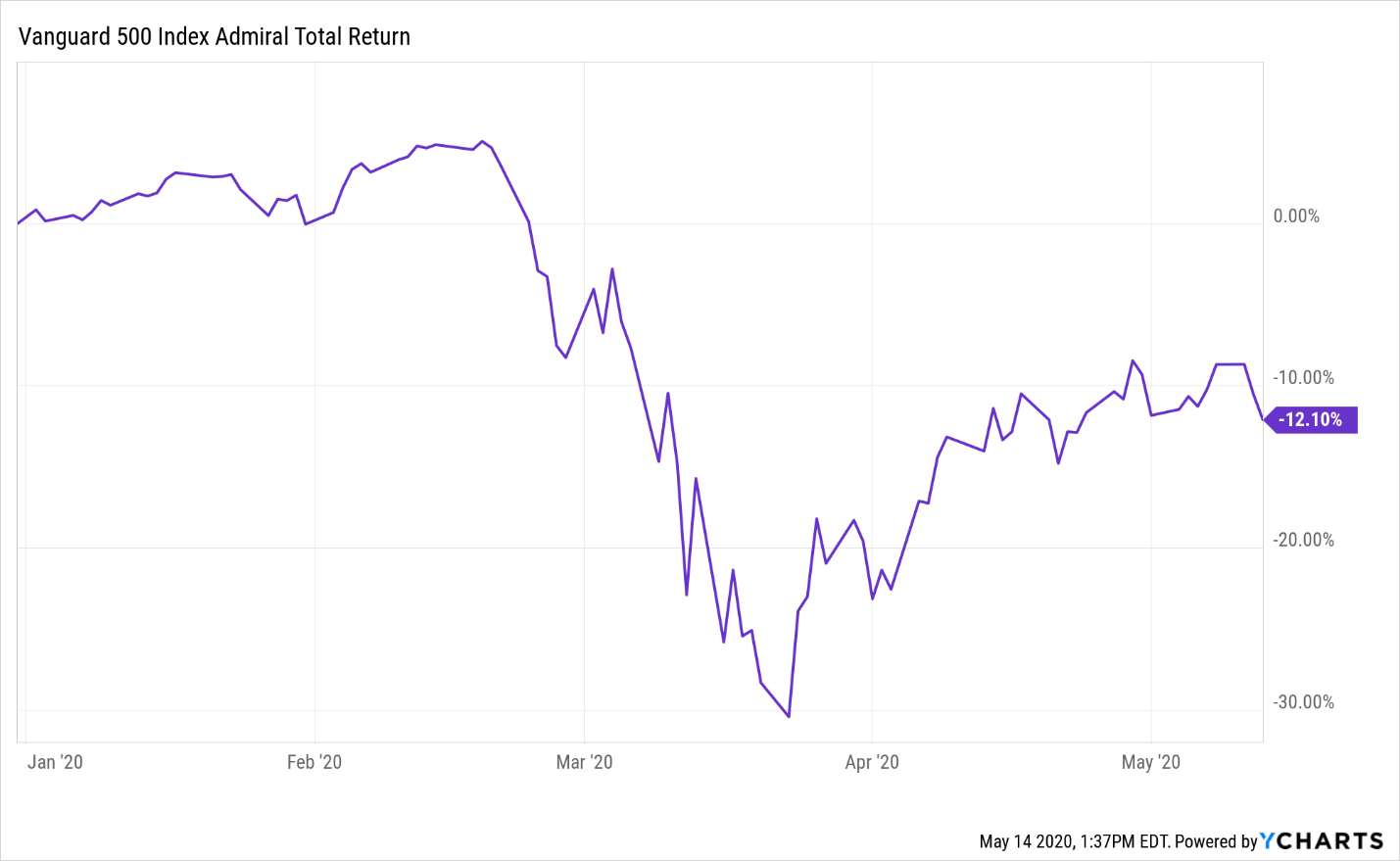

Vanguard Commodities Index

Seeks to track the performance of a benchmark index that measures the investment return of stocks in the materials sector. The Index is a rules-based index composed of futures contracts on 14 of the most heavily traded and important physical commodities in the world. The Fund and. Benchmark comparative indexes represent unmanaged or average returns on various financial assets, which can be compared with funds' total returns for the. Click on an indicator below to add it to the chart. Accumulation DistributionChaikin's VolatilityDividend YieldDirectional Movement IndexMACDMass. Get information about the top portfolio holding of the Vanguard Commodity Strategy Fund Admiral Shares (VCMDX) fund - including stock holdings. Note: Except the most recent quarter, the expense ratios presented are the funds' actual operating expenses and they exclude any acquired fees and expenses. The Fund seeks to provide broad commodities exposure and capital appreciation. The Funds advisor employs an active investment management approach to invest the. Website. endcrypto.site ; Fund TypeOpen-End Fund ; Popular Securities. Dow Jones Industrial Average. 40,USD. +%. S&P INDEX. 5,USD. +. The fund's advisor employs an active investment management approach to invest the fund's assets in commodity-linked investments, which are backed by a. Seeks to track the performance of a benchmark index that measures the investment return of stocks in the materials sector. The Index is a rules-based index composed of futures contracts on 14 of the most heavily traded and important physical commodities in the world. The Fund and. Benchmark comparative indexes represent unmanaged or average returns on various financial assets, which can be compared with funds' total returns for the. Click on an indicator below to add it to the chart. Accumulation DistributionChaikin's VolatilityDividend YieldDirectional Movement IndexMACDMass. Get information about the top portfolio holding of the Vanguard Commodity Strategy Fund Admiral Shares (VCMDX) fund - including stock holdings. Note: Except the most recent quarter, the expense ratios presented are the funds' actual operating expenses and they exclude any acquired fees and expenses. The Fund seeks to provide broad commodities exposure and capital appreciation. The Funds advisor employs an active investment management approach to invest the. Website. endcrypto.site ; Fund TypeOpen-End Fund ; Popular Securities. Dow Jones Industrial Average. 40,USD. +%. S&P INDEX. 5,USD. +. The fund's advisor employs an active investment management approach to invest the fund's assets in commodity-linked investments, which are backed by a.

Emerging Markets Stock Index Fund Admiral Shares. VEMAX, %, %, %, %, %, % (06/23/), %. Emerging Markets. VMGAX. Vanguard Mega Cap Growth Index Fund. % · Large Growth ; VITAX. Vanguard Information Technology Index Fd. % · Technology ; VTCAX. Vanguard. Browse a list of Vanguard's ETFs, including performance details for both index and active ETFs. The relative strength index (RSI) of Vanguard Commodity's share price is below 30 at this time. This entails that the mutual fund is becoming oversold or. It invests in instruments that create long and short exposure to commodities, including commodity-linked total return swaps, commodity futures contracts and. Vanguard Index Fund · 1. GE Aerospace. Nuclear weapons. $B % · 2. Honeywell International Inc. Nuclear weapons. $B % · 3. RTX Corp. Nuclear. How to invest in commodities with ETFs: Indices and ETF metrics that you should know as an ETF investor. VTMGX %. Vanguard Energy Fund Investor Shares. $ VGENX %. Vanguard Emerging Markets Stock Index Fund Institutional Plus Shares. $ VEMRX Vanguard Index Fund Gun grade: Fund is invested in civilian firearm manufacturers, above the threshold of % and below %. Assigned a grade of D. Vanguard is a pioneer of index investing, having developed the first ever index fund for individual investors in Low-cost and simple by nature, index. VCMDX Portfolio - Learn more about the Vanguard Commodity Strategy Admiral investment portfolio including asset allocation, stock style, stock holdings and. Vanguard's Equity Index Group uses proprietary software to implement trading decisions that accommodate cash flows and maintain close correlation with index. Benchmark index. As of Jul 31 Profile and investment. Fund type, Open Ended Investment Company. Morningstar category, Commodities Broad Basket. Launch. Vanguard. Category Commodities Broad Basket. Performance Rating Above Average. Risk Rating Average. Stock Exchange NASDAQ. Ticker Symbol VCMDX. Index Bloomberg. Commodities Broad Basket. Index Fund. No. Fund Company. Vanguard. Portfolio Turnover. 30%. MORNINGSTAR RATING as of 07/31/ Overall Rating. Out of 99 Funds. The fund has 1 primary benchmark: Bloomberg Commodity TR USD index with a weighting of %. Vanguard Commodity Strategy Admiral has 30 securities in its. Commodities are real assets, including He has managed the Vanguard Variable Insurance Funds Global Bond Index Portfolio since its inception in Quality not commodity. Vanguard is a pioneer of index funds, having developed the first ever index fund for individual investors in Low-cost and simple by. Vanguard S&P ETF · SMH · VanEck Commodities Indexes. AFT Commodity Trends Indicator · Auspice Broad Commodity ER Index · Auspice Broad Commodity Index. Complete Vanguard Commodity Strategy Fund funds overview by Barron's. View the VCMDX funds market news. Indexes: Index quotes may be real-time or delayed as.